The benefits of data observability are widely understood by most financial institutions, but the discussion typically focuses on operational improvements. However, data observability can also directly affect customer experiences for the better.

Unfortunately, business leaders may not realize just how much data observability can improve customer experiences. Indeed, data has the power to completely revolutionize the way businesses operate and communicate with customers. Here are some ways that financial institutions have already started using data observability to change their operations for the better.

How Financial Institutions Are Using Data Observability Now

Improving Prediction and Detection of Threats and Breaches

Financial institutions provide critical services to governments, businesses, and individuals. It is extremely important that financial institutions take this responsibility seriously. Security breaches and threats can put business continuity at risk.

Data observability gives IT and security teams a holistic overview of financial institutions’ data health and potential weak points at all times. This allows them to predict and detect threats and breaches quickly and effectively.

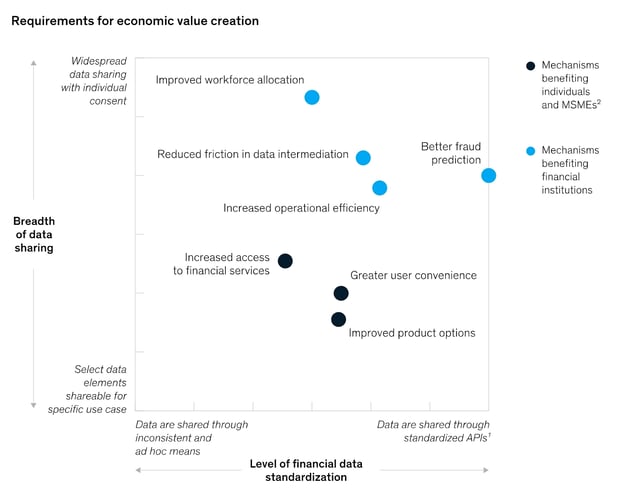

Financial institutions can also use data observability to conduct fraud prevention, which requires high levels of financial data standardization and widespread data-sharing processes.

Overcoming Data Silos Created by Inconsistent Adoption of Digital Solutions

Financial institutions, like many other businesses, generate a staggering amount of data. However, they are not always able to make the most of this data because of data silos. Silos prevent information from passing smoothly across department lines. This can make it extremely difficult for business leaders to receive a truly holistic overview of their business and can prevent salespeople from gaining a complete picture of their customers' needs.

Digital tools were supposed to make it easier for employees at every level to share and receive information but these solutions are often used inconsistently across the organization. The popularity of highly specialized tools within finance and technical departments also further entrenches existing silos. Data observability allows financial institutions to overcome the challenges these silos cause by creating a high-quality and reliable single source of truth over a stack of integrated and interoperable digital tools.

Increasing Productivity with Workflow Automation and Optimization

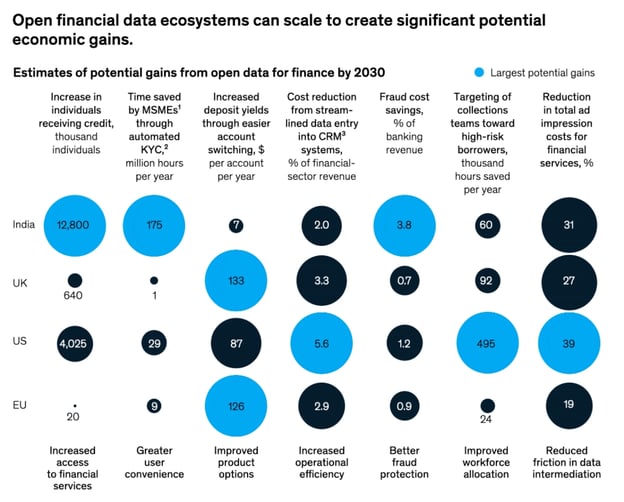

As hiring new talent becomes increasingly difficult, financial institutions have turned to data to find new insights about how they can maximize their output with limited resources. Data can help business leaders find new workflows and automations that can save operational and administrative teams thousands of hours each year.

In the United States, financial institutions have discovered the massive potential growth in optimized targeting of collection teams, which is possible with open financial data ecosystems. Data observability is the basis of these optimization efforts as it provides business leaders with a complete picture of the assets they have and how each of these assets can be used to maximize value to the organization.

Why Positive Customer Experiences Should Be a Priority for Financial Institutions

Data can definitely provide significant insight into operational performance and financial institutions are adept at using it that way. However, data can also be used to develop a better understanding of customers and the experiences they want to have at the financial institution.

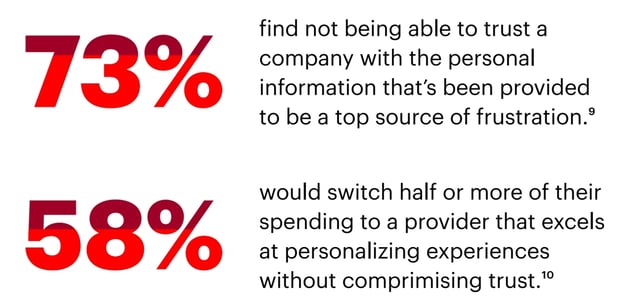

A banking study conducted by Accenture revealed that 58% of customers would switch to a different bank if the competitor provides excellent personalized service without compromising trust. While customers want financial institutions to use their data to deliver better and more personalized experiences, they also demand strong data management plans to ensure that the data collected is safe.

The Impact of Data Observability on Customer Experiences

Identify and React to Issues Flagged by Customers Through Any and All Touch Points

Customers have a wide variety of touch points to choose from when interacting with a financial institution. They can choose to call a customer service representative, visit a branch, fill out an online form, and so on. This data is often collected and stored using different means and tools.

Data observability allows this information to be collated and linked to individual customer profiles without compromising data integrity or fidelity while it is in transit. Issues flagged by customers are more likely to be responded to in a timely manner when customer interactions are consolidated and easily retrieved.

Receive Actionable Insights Over Customer Experiences Based on the Latest Customer Interactions and Sales Data

Customer needs and preferences evolve as demographics, social beliefs, and customer priorities change. Business leaders must stay abreast of these changing preferences to keep customer experiences aligned with their expectations.

Customer interactions and sales data can help department leaders understand how customer behavior is changing in real time and use those insights to plan future products, in-branch experiences, and more. However, it is important that this insight is generated using accurate and complete data.

Financial institutions that conduct regular data analysis must also keep an eye on the health of their data to yield the desirable results from data programs.

Encourage More Conversions by Providing Salespeople With All the Relevant Information They Need to Close a Sale

Salespeople and customer service staff are crucial touchpoints to convert the modern customer and as such, they must be empowered to engage with customers in the most effective way possible. This involves giving them access to a complete repository of customer information that is easily accessible through a single platform.

Data observability also gives salespeople an accurate view of their customers’ needs and allows them to match the right products and solutions. This puts salespeople in the best position to close sales and find upsell opportunities effectively.

Data is often at the center of operational activities. Financial institutions have long used data to reduce costs, improve security, and increase productivity. However, customer and operational data can also be used to enhance customer experiences across platforms and engagement channels. Data observability allows businesses to explore this while keeping critical operational data safe and accurate at the same time.

Author Bio:

Loretta Jones is VP of Growth at Acceldata.io with extensive experience marketing to SMBs, mid-market companies, and enterprise organizations. She is a self-proclaimed 'startup junkie’ and enjoys growing early-stage startups. She studied Psychology at Brown University and credits this major to successful marketing as well as navigating a career in Silicon Valley. She’s a nature lover and typically schedules her vacations around the migratory patterns of whales and large ocean creatures.