“When will we be back to normal?” That’s a million-dollar question. The economy, and more importantly consumer behavior, has changed during COVID. Everyone is contemplating the shape of a post-COVID recovery.

There is a very simple matrix that can help determine what could happen in 2021 and what you need to do to be in the best position now and in the future. To fully understand the implications, you need to understand why the COVID economic challenges were so different from the Great Recession AND what it can still teach us.

Don’t confuse the pandemic for another Great Recession.

The key difference is obvious: The COVID economy was not a failure of Wall Street or a real estate bubble. It was a global event that changed behaviors. That impact was felt much more quickly than what was seen during the Great Recession.

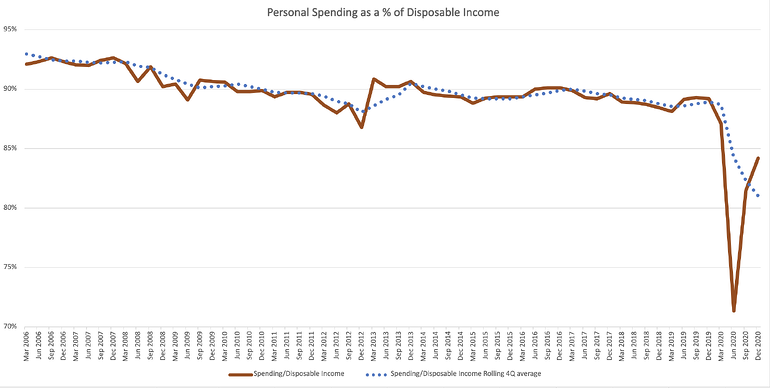

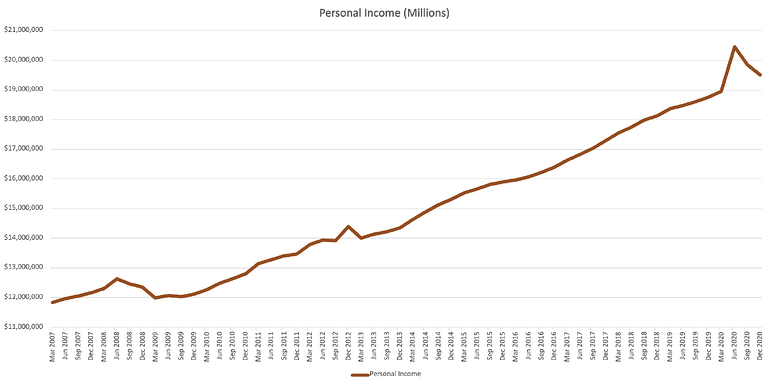

One way of looking at that consumer behavior is to review the percentage of U.S. disposable income that was actually spent. From 2006 to 2012 (just prior to the Great Recession and the immediate period after), there was a general decline in the percentage of disposable income that was spent, but single-quarter change was never more than 1.5 percentage points off from the rolling four-quarter average. From December 2019 to December 2020, spending fell from 89.2% of disposable income to 81.1%, with a dip down to 71.3% in June of 2020. Practically overnight, consumers reduced spending. Meanwhile, personal income rose 4% over the same December 2019 to December 2020 timeframe. The Great Recession began with a much flatter income curve, only 1.3% growth from March 2007 to March 2009.

Source: Bureau of Economic Analysis (bea.gov)

Source: Bureau of Economic Analysis (bea.gov)

The Great Recession recovery still has a lot to teach us about the COVID economy.

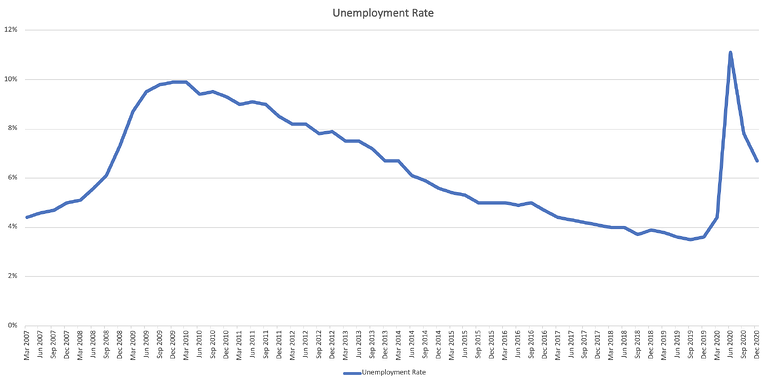

Both eras have been marked by a steep impact on the workforce and general consumer sentiment. In the Great Recession and the COVID economy, the Consumer Confidence Index dropped quickly from well over 100 to below 99, and unemployment rose quickly from near 4% to nearly 10%. The similarities hopefully end there. The COVID impact on workforce and consumer psyche is primarily related to personal safety guidelines. Stimulus helped to curb impact to personal income and herd immunity holds the key to a quick reversal of trends.

Source: Organisation for Economic Co-operation and Development (data.oecd.org)

Source: Bureau of Economic Analysis (bea.gov)

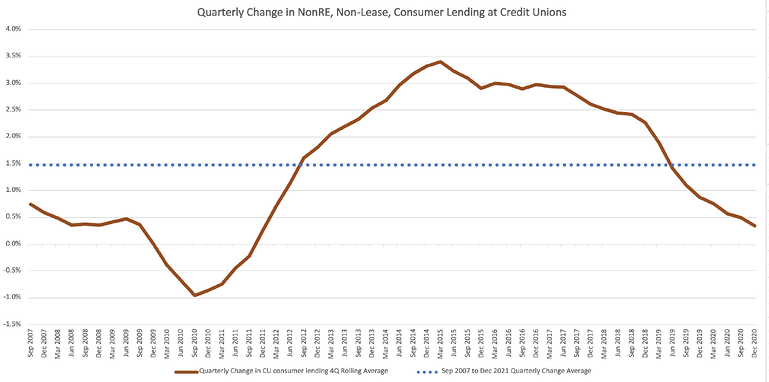

So when did banks and credit unions “recover” during the Great Recession? Rising unemployment slowed in 2009 (and began steady improvements in early 2010). Personal income levels steadily rose beginning in early 2009. As a result, consumer confidence stabilized in 2009/10 and began a steady upward trend in 2011. The tangible impact of those metrics can be seen in the rolling average quarterly change in consumer lending.

True consumer lending at credit unions began a rapid recovery in late 2010, coinciding with the improvements in economic metrics. That period of rising or above average growth lasted until June 2019…just prior to the impact of COVID.

Source: NCUA data

2021 is giving us some strong signals about what’s next.

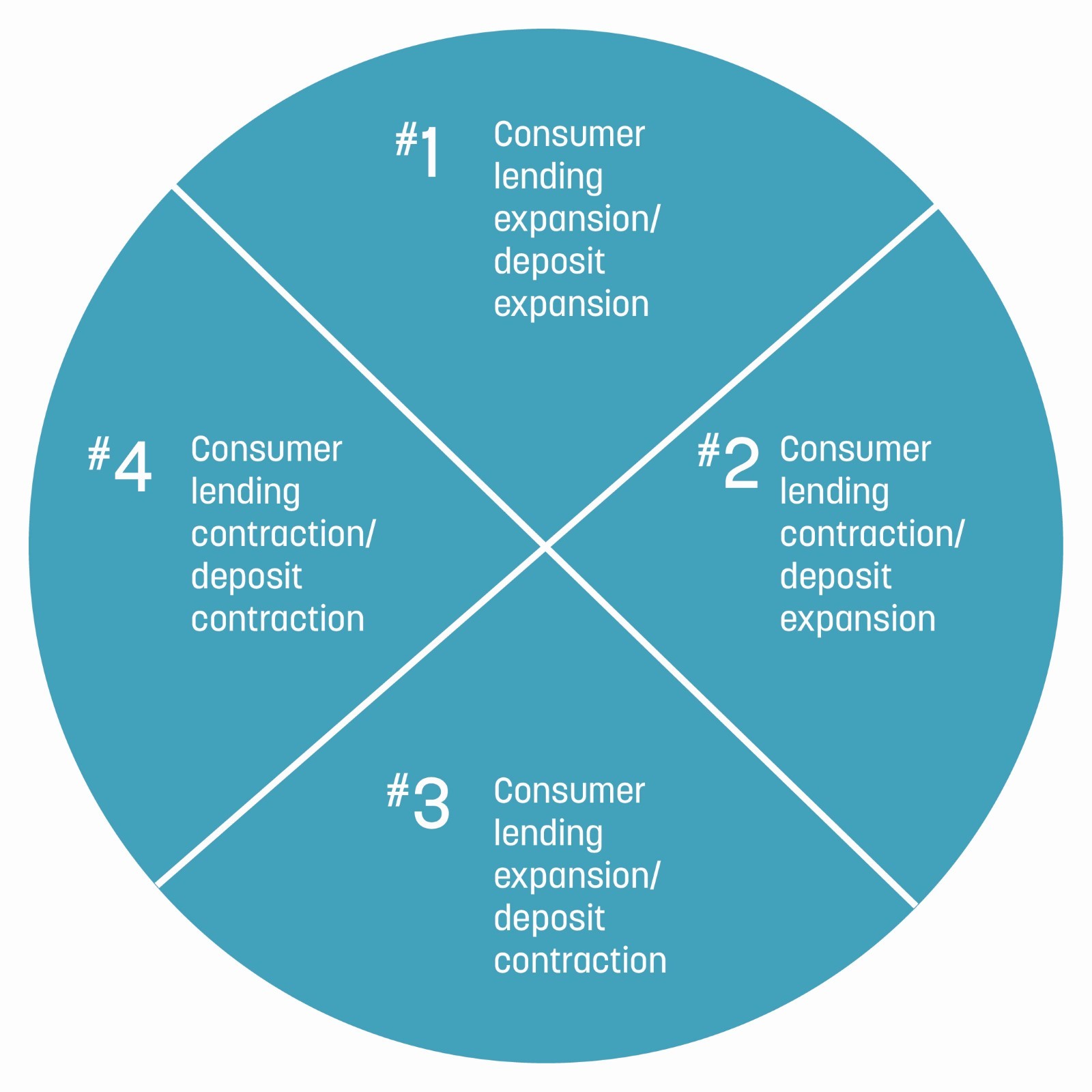

That brings us to the possibilities for 2021. Those same economic indicators that showed recovery for the Great Recession are moving in the right direction in the present. Unemployment is recovering and seems tied directly to COVID precautions. Personal income is high and buoyed by stimulus. Consumer confidence shows signs of rebound and remains at a level seen during the highest levels of consumer loan growth. With those signs, we can build out a possibility matrix.

Figure 1: The Possibility Matrix.

Which is most likely? The conditions for deposit growth continuing at above average levels are still in place (increased income, increased savings). Commercial lending (with things like PPP) has been a source of growth. That really leaves the question between consumer lending expanding or continuing to be a challenge. For 2021, it will likely be a mixed result. Lending could expand, but perhaps not until later in the year, when COVID restrictions are expected to improve nationally and in force. Thankfully, there will be pockets of strong improvement and overall recovery could happen sooner. There is too much supply built up in consumer’s wallets…it will seek an outlet.

Reasons to be hopeful lending will expand in 2021

-

Vaccines, an open economy, and travel

-

Consumer confidence that continues to rise

-

A buildup in savings allows consumers more flexibility to spend/borrow

Reasons to expect lending could be a challenge in 2021

-

COVID restrictions aren’t eased with enough time to impact 2021

-

While income and savings are high, consumption is still well below historic levels

-

Without adaptability and resilience, 2021 is going to be painful.

Either scenario will present a challenge for all but the luckiest community financial institution leaders. Compressed margins exposed that many community banks and credit unions were overly reliant on interest revenue, and few were prepared to adapt to the extreme change in consumer behavior.

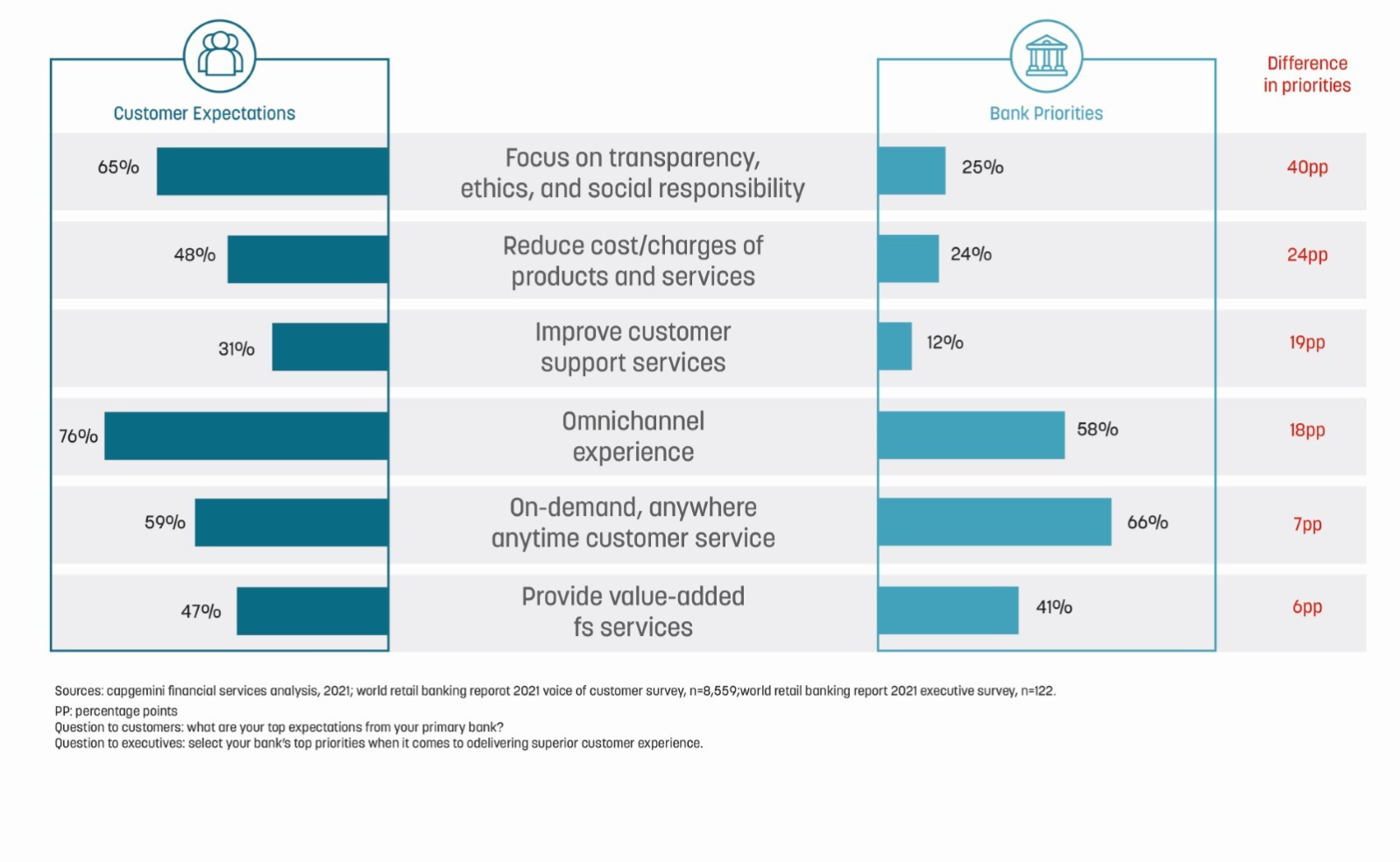

And that change in consumer behavior is not going away. Community financial institutions must align with consumer expectations.

Figure 2: The gap between customer expectations and bank priorities continue to widen.

Challenges if lending expands in 2021

-

Competition for the consumer (Big tech, neobanks)

-

Consumer expectations (consumer experience, social responsibility)

Challenges if lending is flat in 2021

-

Everything above, plus…

-

How do you connect with consumers that are now more discerning?

-

ALCO pressures: need to make up for 2020

The 5 strategies you need for 2021 (and 2022, 2023, 2024…)

The best way to win is to be far better than ever at developing, gaining and retaining engaged consumers. Engaged consumers lead to deeper relationships and deeper relationships lead to more profit. There are five ways to be more effective at this than you were in 2020.

1. Embrace digital transformation: Consumers want to do business from a distance…let them! The “branch” is not obsolete, but your digital experience (website/app) might be. How long would it take a 25-year-old to find details about a product on your website or submit an application with all required documents and automated actions like identity verification? If the answer is “I don’t know” or “they can’t”, then you have a challenge. You can’t just meet in the middle; you have to reach farther:

-

Digital account acquisition

-

A website that provides an effective sales funnel

-

Products that encourage adoption of non-branch transactions

2. Dive into the deep end of relationships: If you are like most executives, you have an excess of liquidity. And you may feel an urge to pull back from acquisition efforts for fear of deposit growth. Here’s the rub; what are consumers doing right now? In 2020, consumers retracted their borrowings in favor of refinancing and consolidation. What is the best way to be first in line for consumer’s borrowing relationship? You need them to think of you as their primary institution. Bring balance to the relationship (and decouple deposit growth from relationship growth) by leveraging higher levels of engagement with that consumer. Engaged consumers show higher levels of:

-

Non-interest income

-

A higher likelihood of cross-sell

-

A higher likelihood to increase loan relationships

3. Employ lending strategies that offer transparency and control: It is obvious that any loan that fits your risk profile would be a positive. The bigger challenge is to align messaging and products with consumer sentiments. Consumers are looking for transparency and social responsibility in their banking relationships. Consumers are keenly aware of one-sided offers and are seeking products and partners that are clearly working for their benefit.

-

Less focus on “new” loans

-

More focus on flexibility, transparency, and financial security

4. Focus on “gateway” relationships: Retail deposits are booming thanks to constrained consumption opportunities (aka stay-at-home orders) and an influx of stimulus dollars. You might not like those dollars now, but those dollars represent consumers and are the primary source of engagement right now. Treating that consumer with indifference in 2021 might make sense on paper but could have negative impacts long-term. A better strategy would be to prioritize those relationships, encourage engagement, and offer transparent reasons for them to do more with you.

-

Don’t chase rates with CDs and money market accounts. They aren’t a strong loyalty indicator and are an expensive way to compete for consumers.

-

Do seek highly transactional “primary financial institution” accounts, as indicated by activity and openness to new offers. Become the natural choice for the next service or product.

5. Engage in data-driven marketing: Most every bank and credit union has been in a “wait and see” mode. Now as we approach the middle of 2021, many are set to take action. The best will act based on a true understanding of the consumers they have now and the ones they can acquire. That understanding is based on data and research. The best will act by matching products and messaging to their targets.

-

Existing account holders have a story to tell: Data mining for trends leads to conversations based on needs

-

Do you know where they are spending their money?

-

Do you know who they pay on a monthly basis?

-

Do you know what percentage of card holders aren’t using your card?

-

-

Not all prospects are equally valuable to your balance sheet: Narrow the spotlight to consumers that will do more and respond

-

Accurate segmentation analysis based on propensity models and channel consumption research

-

If you don’t want single-service CD shoppers, how certain are you that your messaging is reaching the people you do want?

-

If you knew what was going to happen in six months, how would you prepare your institution? Well, here’s some good news: we already know how the world is changing and are only waiting for the pace to pick up.

If you only focus on the forest, you forget about the trees (to your detriment).

For the majority of banking history, community financial institutions have grown using the strength of organic relationships, and when everyone is your neighbor, you’re in touch with their needs. More recently, marketing and technology have allowed institutions to scale faster and farther, leading some to neglect the work of connecting with individual account holders. In the post-COVID economy, the best way to survive and thrive will be to work on strategies that have positive impacts now AND create options in an uncertain future. Fortunately, there are partners, such as Kasasa, that can help you implement technology to connect with consumers 1:1 and offer products and services that create sustainable long-term relationships.

About the author:

Patrick Dickson serves as the Chief Research Analyst for Kasasa. Patrick analyzes Kasasa’s vast data set and economic conditions to uncover and refine insights that result in actionable intelligence for Kasasa’s community financial institution partners. Patrick has extensive experience in strategic planning, financial analysis, mergers & acquisitions, and stock valuation.