NXTsoft, the leading provider of data and image migrations to the financial industry, released its quarterly review of industry merger and acquisition data for the first quarter of 2020. Derived from data provided by the Federal Reserve System, the research quantifies all U.S. bank M&A activity closing in the first quarter of 2020.

To say that 2020 has started off with challenges would be an understatement. Coronavirus crisis, oil price war and a near stock market crash are all just some of the challenges that were presented and faced in the first quarter of 2020. To the surprise of few, global M&A activity reflected those challenges and is down significantly from this point last year. In fact, the overall global M&A decline is 28% lower than this time a year ago. With all of that said the actual number of Banking M&A deals closed in the US in Q1 was slightly up from 2019 – a 6% increase. The first quarter saw 69 deals close in 2020 versus 65 in 2019. This is the highest number of deals closed in the first quarter since 2015, but due to the market, not a trend that is predicted to continue. The Covid-19 pandemic is bringing the global transactions market to a near standstill with a sharp slowdown in deal-making, likely to persist until the public health crisis is brought under control. Even then, the market, and the motivations of investors, may look very different.

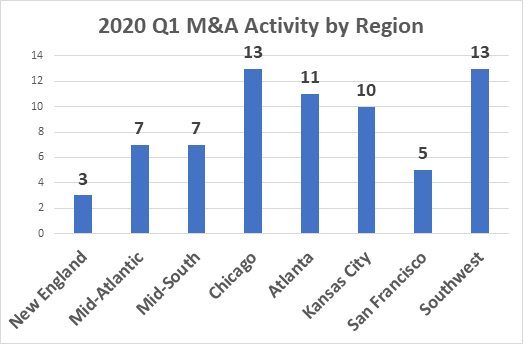

While the M&A outlook for 2020 is strained at best, there are some interesting finds in the first quarter. Historically speaking, the Chicago and Kansas City regions always lead the charge in terms of deal volume. In fact, over the last 5 years, these two regions alone have accounted for over 40% of all US mergers and acquisitions. While both regions still had great showing in Q1 of 2020 the over all deal volume has been far more spread out. For instance, the Atlanta region saw 11 deals in Q1 which is the single highest quarter in four years for that region. The Southwest (Dallas) region had a massive 44% increase in deals from Q1 of 2019 with the largest quarterly deal volume since 2015 for them in 13 deals. This trend continued in the Mid-Atlantic region (7 deals) and the Mid-South region (7 deals) as well. Overall, the first quarter saw deals much more spread out across the country than is typical.

“Given the current circumstances in both the market and the country, this is a trend that should continue as financial institutions continue to look outside of their “normal” markets for acquisition targets and better opportunities,” said Bobby Childs, vice president of business development for NXTsoft.

The forecast for mergers and acquisitions for the rest of 2020 is cloudy at best. Currently there have been 36 deals announced in Q1 which is a 25% decrease from Q1 of 2019 and a 61% decrease from deals announced in Q4 of 2018. We have seen on several occasions in previous years where deals announced quarter over quarter drop and then rebound. We have also seen where the deals announced are significantly lower than the deals that do close in the following quarter. However, the consensus is that Q2 and Q3 of 2020 are going to be far slower quarters in terms of M&A activity. During the record-breaking bull run in global transactions that began more than six years ago, it has at times felt like the M&A market had become impervious to external shocks. While all cycles do eventually end, few guessed that it would be one catastrophic event that would eventually drag the market to a sudden halt. But the onset of the coronavirus (Covid-19) pandemic has done just that – at least in the short term.

However, one thing to always keep in mind is the resiliency and ingenuity of the American people and our economy. Sadly tragedies occur that have a dramatic effect on business, but one thing that has always occurred in the face of tragic events is ingenuity, creativity and an overall drive to not only push through the tragedy, but to also find success in its midst. It is possible from a merger and acquisition standpoint, that as a result of the uncertainty, different types of deals will start to come into the pipeline. For example, distressed deals, restructurings, consolidations and joint ventures are all possibilities. There are real reasons to be hopeful that the M&A market will revive and do so strongly. The world has changed, but change can often spur innovation.

Other notable insights from the fourth quarter of 2020 include:

- The Chicago and Southwest regions had the most deals closed in Q1 with 12 deals closed each.

- The New England region had the fewest amount of deals closed in Q1 with only 3 deal closed.

- Q1 of 2020 has had the most deals closed in the first quarter since 2015.

- 40% of the past 5 years deals came from the Chicago and Kansas City regions.

- The first quarter averages almost 66 deals over the past 5 years.